Fair Value Gap (FVG): Smart Money Trading Strategy

Master the 3-candle pattern Fair Value Gap to identify market imbalances and trade high-probability retest entries using Smart Money Concepts. This comprehensive guide teaches you how to spot FVGs - price inefficiencies created by aggressive buying or selling - and use them to predict where price will return to "fill the gap." Learn the exact 3-candle rule for identification, understand why markets revisit these zones, and implement a complete trading strategy with precise entries, stop losses, and profit targets. Perfect for beginners with interactive diagrams and step-by-step strategy navigation.

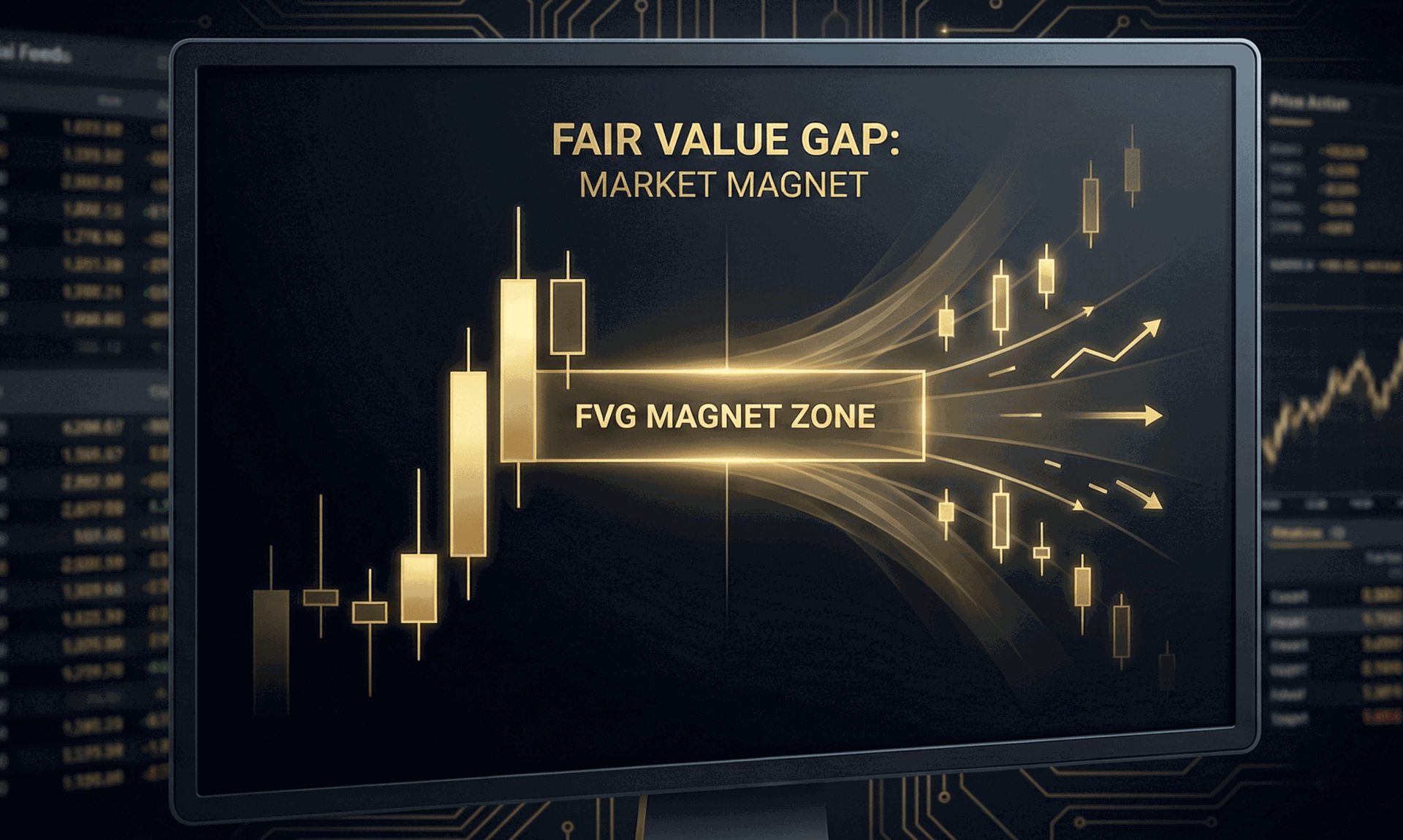

The Fair Value Gap "Market Magnet" - Price is often drawn back to the FVG zone to rebalance inefficiencies before continuing its trend. This 3-candle pattern creates high-probability retest opportunities for Smart Money traders.

The Fair Value Gap "Market Magnet" - Price is often drawn back to the FVG zone to rebalance inefficiencies before continuing its trend. This 3-candle pattern creates high-probability retest opportunities for Smart Money traders.

Master the 3-candle pattern Fair Value Gap to identify market imbalances and trade high-probability retest entries using Smart Money Concepts. This comprehensive guide teaches you how to spot FVGs - price inefficiencies created by aggressive buying or selling - and use them to predict where price will return to "fill the gap." Learn the exact 3-candle rule for identification, understand why markets revisit these zones, and implement a complete trading strategy with precise entries, stop losses, and profit targets. Perfect for beginners with interactive diagrams and step-by-step strategy navigation.

What is a Fair Value Gap (FVG)?

A Fair Value Gap (FVG) is a three-candle price pattern that indicates a market inefficiency or imbalance. It occurs when aggressive buying or selling creates a gap between the wick of the first candle and the wick of the third candle, leaving a price range that has not been "fairly" delivered to both buyers and sellers.

In simpler terms: when price moves so fast in one direction, it skips certain price levels. These skipped levels become "unfair" zones that the market tends to revisit to achieve balance.

Why is everyone talking about FVGs?

In the world of Smart Money Concepts (SMC), price doesn't move randomly. It moves to seek liquidity and to rebalance inefficiencies.

Think of the market like a painter painting a wall. If they swipe the brush too fast in one direction, they might leave spotty patches (gaps). Eventually, they must return to fill in those patches to make the wall "fair" and complete. FVGs are those spotty patches on your chart.

FVG vs Traditional Gap: What's the Difference?

Many traders confuse Fair Value Gaps with traditional price gaps. Here's the key distinction:

| Aspect | Traditional Gap | Fair Value Gap (FVG) |

|---|---|---|

| Formation | Weekend/overnight when markets are closed - no trading occurs | Aggressive intraday buying or selling - trading occurs but only in one direction |

| Timeframes | Daily charts and higher (requires market closure) | All timeframes (1-minute to monthly) - fractal pattern |

| Fill Rate | ~70% eventually fill (but timing unpredictable) | ~85% fill within the prevailing trend (higher probability) |

| Identification | Empty space between candle closes | Gap between candle 1 high and candle 3 low (or vice versa) |

| Trading Strategy | Gap fill trades (often mean reversion) | Retest trades aligned with trend (continuation) |

| Volume Behavior | Often accompanied by volume gaps | High volume on impulse candle (candle 2) |

| Market Type | Mainly stocks, indices (markets that close) | Forex, crypto, stocks, indices (any liquid market) |

Key Takeaway: While traditional gaps require market closures, Fair Value Gaps form during active trading when price moves so aggressively that it creates an imbalance. FVGs are more reliable for intraday trading and work across all asset classes.

How to Identify FVG: The 3-Candle Rule

How to spot a valid Fair Value Gap in real-time. Toggle the view below to understand both bullish and bearish FVG patterns.

How to Trade Fair Value Gaps: Complete Strategy

A step-by-step framework for trading FVG retests. Don't chase price; let it come to you. Follow these 4 steps for high-probability entries.

Step 1: Identify Market Structure

Before looking for gaps, ensure the trend is in your favor. Here, we have a clear Uptrend (Higher Highs, Higher Lows).

Step-by-Step FVG Trading Guide

1. Identify Market Structure

Before looking for gaps, ensure the trend is in your favor. Confirm you have a clear uptrend (Higher Highs, Higher Lows) or downtrend (Lower Highs, Lower Lows). Trading FVGs aligned with the primary trend dramatically increases your success rate.

2. Spot the Impulse & FVG

Look for a big, energetic move that creates the gap. In a bullish FVG: identify the gap between the high of candle 1 and the low of candle 3. In a bearish FVG: identify the gap between the low of candle 1 and the high of candle 3. The middle candle (candle 2) should show strong momentum.

3. Wait for the Retest

Exercise patience - this is where most traders fail. Do not buy at the top of a bullish impulse or sell at the bottom of a bearish impulse. Wait for price to retrace back into the FVG zone. Look for additional confirmation:

- Bullish/bearish candle close within the gap

- Volume spike indicating renewed interest

- Reversal candlestick patterns (hammer, engulfing, etc.)

4. Set Stop Loss & Take Profit

- Entry: Inside the gap zone (middle of the FVG range for optimal risk/reward)

- Stop Loss: Below the impulse candle low (bullish) or above the impulse candle high (bearish)

- Take Profit: Next structural high/low, resistance/support level, or previous swing point

- Risk/Reward: Aim for minimum 1:2 ratio (example: 15-point stop for 30-point target)

What Are Common FVG Trading Mistakes?

Avoid these 3 costly errors when trading Fair Value Gaps. Click each mistake to reveal detailed solutions, ChartLense AI features that help prevent them, and related lessons.

Fair Value Gap Trading FAQ

Get answers to the most common questions about trading FVGs across different timeframes and markets.

Ready to Spot Your First FVG?

Next Steps: Master Related Concepts

When you combine Fair Value Gaps with these other tools, your success rate improves dramatically:

- Lesson 3: Support & Resistance - FVG + S/R confluence creates high-probability setups

- Lesson 4: Volume Analysis - Confirm FVG strength with volume spikes during impulse moves

- Lesson 5: Trend Structure - Understand market structure context for FVG validity

By mastering these complementary concepts, you'll develop a complete Smart Money trading framework that gives you an edge in any market condition.

📖 Dive Deeper with TradingView

💼 Trade Smart Money Concepts